Isn’t it ironic? Media consumption has skyrocketed as consumers shelter at home, spending record time on social media, video streaming and other online services. While the amount of digital ad space is expanding, the demand for marketing spots is shrinking.

Facebook and Google will lose over $40 billion in combined advertising revenue in 2020 due to the coronavirus pandemic, predicts Cowen & Co., an investment management firm. Twitter recently reported usage is up but global advertising is down so much that the social media platform cut its sales forecast.

Digital ads earn more than $300 billion a year from companies big and small. Google and Facebook account for more than half of that, according to a report produced by research firm EMarketer. Read the report

Big digital ad losses predicted

EMarketer predicts the following losses:

- Facebook: roughly $15.7 billion, 18.8% down from its original estimate.

- Google: roughly $28.6 billion, 18.3% below estimate.

- Twitter: roughly $701 million, 17.9% below estimate.

- Snapchat: roughly $709 million, 30% below estimate.

YouTube creators report their CPM revenue has been slashed by 20% or more. CPM stands for “cost per mille.” Mille is Latin for “thousand.” Therefore, CPM determines how much revenue a YouTuber makes per thousand views.

Conversely, Nature League, an outdoor channel, reported its YouTube ad revenue CPM increased 318% during the last 6 weeks. Watch-time for videos on the channel has increased by 400% as teachers share videos.

Even Amazon cut ads

Marketing, PR and advertising are often the first budgets to slash during times of unrest. This time is no exception. Even Amazon, one of Google’s best customers, cut its Google ad spend.

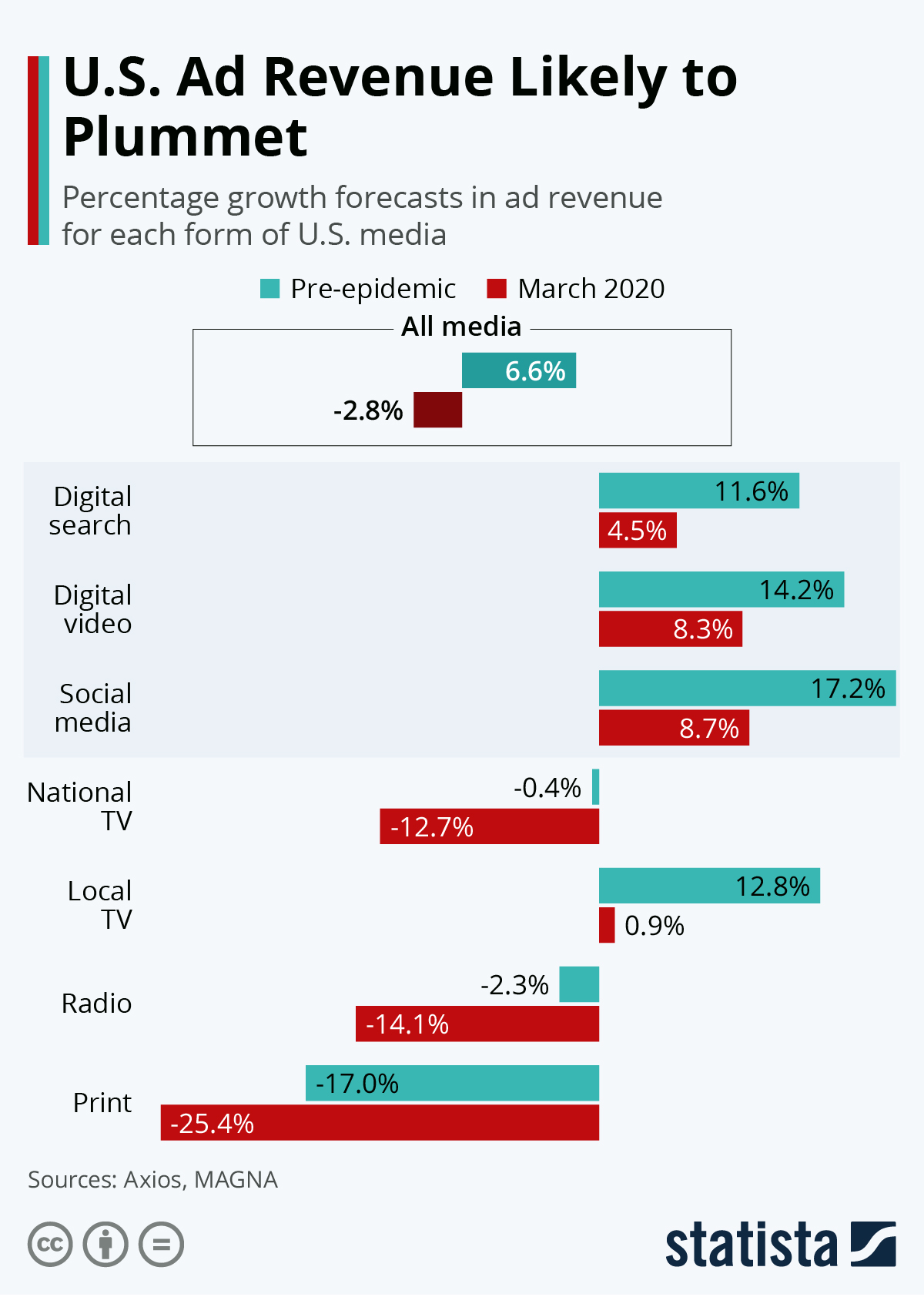

The Statista chart below shows the growth forecasts in ad revenue for each form of media, including digital search, digital video, social media, national TV, local TV, radio and print.

Recent articles

- How to engage clients with newsletters

- How to resize blog images

- Facebook boasts 3B monthly active people

- Digital advertising market shrinking

- Consumers crave authentic marketing: infographic

Thanks for visiting the Aristeen website. If you are interested in any of our digital marketing or content development services, please contact me directly at

Thanks for visiting the Aristeen website. If you are interested in any of our digital marketing or content development services, please contact me directly at